Nofsinger and Varma (2014)

Nofsinger, John, and Abhishek Varma. “Socially Responsible Funds and Market Crises.” Journal of Banking and Finance, 2014.

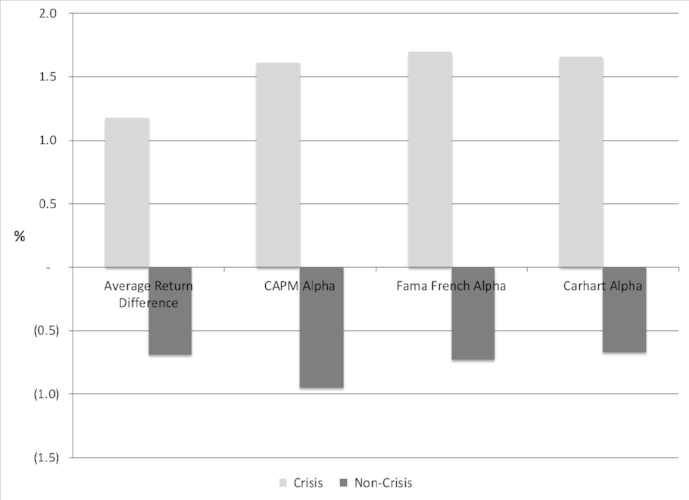

From the author's abstract: "Compared to conventional mutual funds, socially responsible mutual funds outperform during periods of market crises. This dampening of downside risk comes at the cost of underperforming during non-crisis periods. Investors with Prospect Theory utility functions would value the skewness of these returns. This asymmetric return pattern is driven by the mutual funds that focus on environmental, social, or governance (ESG) attributes and is especially pronounced in ESG funds that use positive screening techniques."

lk chart of alpha from different models as presented in the paper

LK comment: Strong paper. This finding is consistent with the broader SRI industry experience of less downside capture during the financial crisis, and less upside capture in its aftermath. Note that the effect was observed not only in the raw returns, but in CAPM, 3-Factor, and 4-Factor alphas, (although only at 10% sigificance level) strongly suggesting that ESG factors are some kind of quality proxy. Includes helpful performance data by issue area, where, again, the effect is seen almost everywhere.

Link (working paper): https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2142343

Link (published article): https://www.sciencedirect.com/science/article/pii/S0378426613004883